COBRA Coverage

I received a COBRA package from J.J. Stanis & Company, Inc.:

Q: What type of coverage is this for?

A: At the bottom of page 7 you will find the Plan information along the rate, begin and end date of the coverage you are being offered.

Q: What do I do if I want to continue with the COBRA coverage?

A: You will need to fill out the election form found on page 11. Your Social Security Number is the ID Number. Please list all dependents to be covered under the plan if you have a family plan. If you have an Individual plan you will only need to put in your information. Coverage type is the coverage you are being offered (Dental, and or Vision). Tier of coverage is Family and/or Individual.

Q: Where do I mail the election form?

A: The mailing information to start off your COBRA coverage can be found at the top of page 11. Please note that once the election form is received, J.J. Stanis Inc. will process it and send remittance coupons to you to make your payments. Please use the address on the coupons to make the remaining payments.

Q: Do I send in any payments with my election form?

A: It is best to send in the election form with your first month’s premium (rate can be found at the bottom of page 7), this way your COBRA coverage can be activated upon receipt of the election form and payment. If the election form is received without payment, COBRA coverage will be activated once a payment is received.

Q: Can I make more than one payment?

A: Yes, all you need to do is include all coupons for the months you are paying with one check for the total.

Q: Is there a different group number when I continue the COBRA coverage?

A: No. COBRA coverage is an extension of the coverage you had while active at work. The benefits and coverage under the plan remain the same.

Dental Benefits

Q. What is the difference between using a participating or non-participating provider?

A. In general, using a Stanis NetPlus provider will save you a considerable amount of money. Our dentists have agreed to accept reduced fees from our members.

Q. How do I find a list of participating providers?

A. Click here for a way to search for in-network providers with Stanis NetPlus.

Q. How do I ask my current dentist to become an in-network provider?

A. Under the Dental Networks Tab on our website you will see an option to Nominate a Provider. Click on this option and you will be prompted to enter the contact information for that dentist. Once you submit that form, we will receive the information and we will reach out to the dentist with all of the information about our network.

Q. My dependent is 19 years old. They are enrolled in college. How do I continue their coverage?

A. You will need to request proof of full-time student status from your dependent’s school. This can be done by either having your child search for Eligibility Verification on their student portal or by contacting the Bursar or Registrar office at the school. Please note that copies of schedules or tuition bills are not acceptable forms of proof.

Q. How can I access my claims online? / How can I see how much in benefits my family has used this year?

A. Click here for the instructions on how to access your account.

Q. What is my group number or my member identification number?

A. This information can be found on any Explanation of Benefits that we have sent you or you can contact our customer service department and we’d be happy to provide that information to you.

Excess Major Medical Plans (including vision coverage through NVA)

Q. What does my Excess Major Medical Plan cover?

A. To receive a full plan description, please contact our office and we will send you the current brochure for the plan that you are enrolled in.

Q. Why is NVA telling me that I’m not covered?

A. If you feel that your coverage should be in effect, please contact our office directly at 1-877-470-3715 and we will work with NVA on your behalf to have your information corrected.

Q. How do I access a NVA network provider?

A. You can visit NVA’s website at www.e-nva.com or to take you to right to the provider search portal, click here. Please make sure you select ShelterPoint as the Group/Sponsor.

Q. Will my Excess Major Medical reimbursement me for my co-payments paid to my doctors?

A. Your Excess Major Medical coverage will not reimburse you for any out-of-pocket expenses related to in-network expenses, such as co-payments. Please contact our office for a full explanation of what your specific plan will cover.

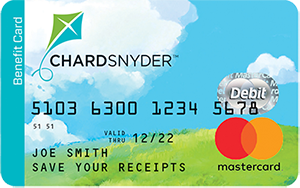

Flexible Spending Accounts

(For claims access):

Q: If a bill is paid in the current flex year, but the date of service is for the prior flex year, which year will the money be taken from?

A: The prior year. Claims are paid by the date of service, not the date the bill is paid.

Q. What is the CARES Act?

A. The Coronavirus Aid, Relief, and Economic Security (CARES) Act is Congress’s latest coronavirus relief package and was signed into law on March 27, 2020. The CARES Act is the largest economic relief bill in United States history and will provide support to individuals and businesses affected by the pandemic. Many of you have questions about the new law and how it impacts your benefits, including items now eligible for purchase with your healthcare flexible spending account (FSA).

Q. Are over-the-counter drugs and medicines now eligible expenses through a Healthcare FSA or HSA without a prescription?

A. Yes. With the new law, you are now able to purchase, or be reimbursed for, certain over-the-counter medications (examples: Tylenol, Motrin, cough suppressants; items that used to require a prescription) using your Healthcare FSA or HSA without a prescription. Please contact your plan administrator to confirm eligible items or visit www.fsastore.com

In addition, any menstrual hygiene products (tampons, sanitary napkins, liners, etc.) may also be purchased or reimbursed using your Healthcare FSA with this new law. The law is retroactive to January 1, 2020, meaning any over-the-counter medications or menstrual products you have purchased since January 1, 2020 can be reimbursed from your Healthcare FSA, if you have not already been reimbursed previously using a prescription.

Q. When can I begin using my Healthcare FSA funds to purchase over-the-counter drugs and medicines, and menstrual hygiene products?

A. You may begin to use your FSA funds for over-the-counter medications and menstrual hygiene products as of January 1, 2020. This new law currently has no expiration date, meaning you may continue to purchase these items with your FSA funds for the entire plan year and beyond. This law is subject to change at any time.

Q. Can I be reimbursed for items I have already purchased?

A. Yes, you can submit a claim to be reimbursed from your FSA for over-the-counter medications not previously reimbursed with a prescription, as well as menstrual hygiene products. You will need to provide a copy of your receipt that shows proof of purchase date and item purchased under FSA. Please contact your plan administrator for specific parameters of eligible dates of service.

Q. What are the different ways that I can submit my flex claim?

A. Claims can be submitted in multiple ways. You can mail your claim to us at our Garden City office. You can also email your claim into us at claims1@jjstanisco.com. You can also use our secure portal to upload your claim by accessing the Claim Submission option under the Contact Us tab on our website.

Q. How can I confirm that you received my claim?

A. You can log into your account via our secure portal and review all claims that we have on file for you. You can find the log in page on our website by clicking the Claims Access option under the Services Tab and follow the prompts to log into your account.

Q. Why are you asking for additional information on my claim?

A. Each claim is different and this answer may not address your specific situation, however, as the administrator of this plan we are bound to adhere to all IRS regulations in the processing of your claim. There are certain items that will require Letters of Medical Necessity, Prescriptions and/or Explanations of Benefits from your primary insurance for example.

Life Insurance

Q: What is a “primary beneficiary”?

A: The “primary beneficiary” is the person or persons who have first rights to receive policy proceeds when the proceeds become payable.

Q: What is a “contingent beneficiary”?

A: The “contingent beneficiary or beneficiaries” is the person or persons designated to receive the policy proceeds if the primary beneficiary should predecease the person whose life is insured.

Q. How do I find out who my beneficiary is?

A. To protect your privacy, we are unable to provide that information. However, if you are unsure of who your beneficiary is, we recommend that you complete a Change of Beneficiary form and submit to us. This new document will supersede any previous designations that you may have had. This document can be located under our Forms tab.

Q. Is there any cash value to this policy?

A. There is not any cash value to this policy.

Q. I received a conversion letter. What is this for?

A. When you lose life insurance coverage under this policy, whether due to a termination or a reduction, you are eligible to convert the amount of coverage you are losing into an individual policy. This would be similar to you going to your nearest insurance broker and asking to purchase a life insurance policy. The only difference is that if you convert under this plan provision, there is no medical exam required. The premium costs are based upon your age and you will be in a direct relationship with the insurance carrier.

Retiree Billing

Q. Am I able to pay my bill using my credit card?

A. Unfortunately, due to NYS Department of Financial Services regulations, credit cards are not acceptable forms of payment for insurance premiums related to certain insurance benefits and therefore cannot be used for these premiums.

Q. How can I submit my new address to you?

A. All address changes need to be submitted to us in writing. You can either mail this information into us at 377 Oak Street, Suite 406, Garden City, NY 11530 or email to us at eligibility@jjstanisco.com

Q. Why did I receive a final notice?

A. Please note that it can take up to 7 business days for your payment to be reflected in our system. You may have received a final notice if your payment crossed in the mail with our final notice. However, if you believe you received a final notice in error, please contact us at 1-877-470-3715 and we will review your account with you.

Q. How long do I have before my payment is due?

A. All bills are due within 30 days of the date of the notice from us. All final notices are due within 21 days of the date of the notice from us.